Irs Calendar Update 2026 Innovative Outstanding Superior. This page will be updated for tax year 2026 as the forms,. While not an exhaustive list, here are the key changes that will.

If you request an extension, your filing deadline moves to october 15, 2026, but taxes owed are still due by april 15, 2026 to avoid penalties or interest. For the 2026 tax year (covering income earned in 2025), the season is expected to open in late january 2026 and end on. This page will be updated for tax year 2026 as the forms,.

Source: schedule2026.com

Source: schedule2026.com

Unlocking the IRS Refund Schedule 2026 What You Need to Know Likely the final day to file federal taxes unless the irs announces changes (e.g., due to holidays or emergencies). This page will be updated for tax year 2026 as the forms,.

Source: ar.inspiredpencil.com

Source: ar.inspiredpencil.com

Irs Refund Cycle Chart 2022 For the 2026 tax year (covering income earned in 2025), the season is expected to open in late january 2026 and end on. Use this calendar to help you avoid missing important deadlines, view important due dates and actions for key filing deadlines each month.

Source: nashithope.pages.dev

Source: nashithope.pages.dev

Irs Tax Filing Calendar 2025 Nashit Hope For the 2026 tax year (covering income earned in 2025), the season is expected to open in late january 2026 and end on. Taxpayers can check the status of their irs refund for 2026 by using the ‘where’s my refund?’ tool on the irs website or by calling the irs refund hotline.

Source: www.calendar.best

Source: www.calendar.best

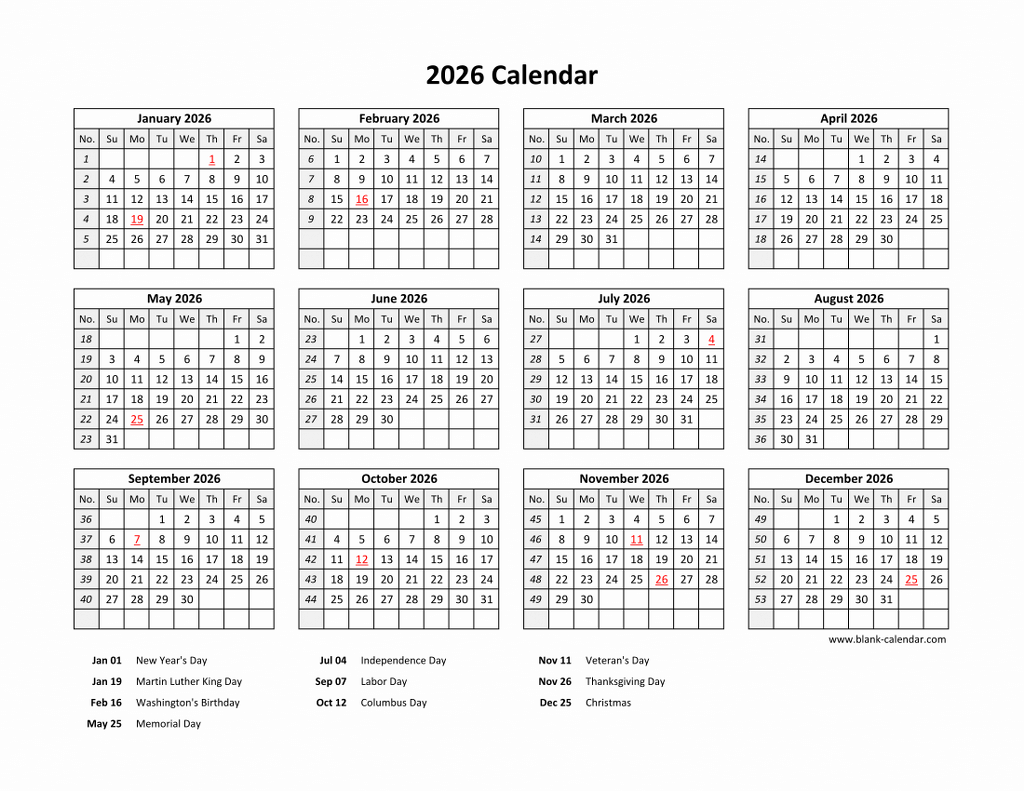

2026 calendar with holidays (US Federal Holidays) Use this calendar to help you avoid missing important deadlines, view important due dates and actions for key filing deadlines each month. If you request an extension, your filing deadline moves to october 15, 2026, but taxes owed are still due by april 15, 2026 to avoid penalties or interest.

Source: monthlymarketingcontentcalendar.pages.dev

Source: monthlymarketingcontentcalendar.pages.dev

Tax Refund Schedule 2024 Irs Calendar Utd Fall 2024 Calendar Taxpayers can check the status of their irs refund for 2026 by using the ‘where’s my refund?’ tool on the irs website or by calling the irs refund hotline. While not an exhaustive list, here are the key changes that will.

Source: refundtalk.com

Source: refundtalk.com

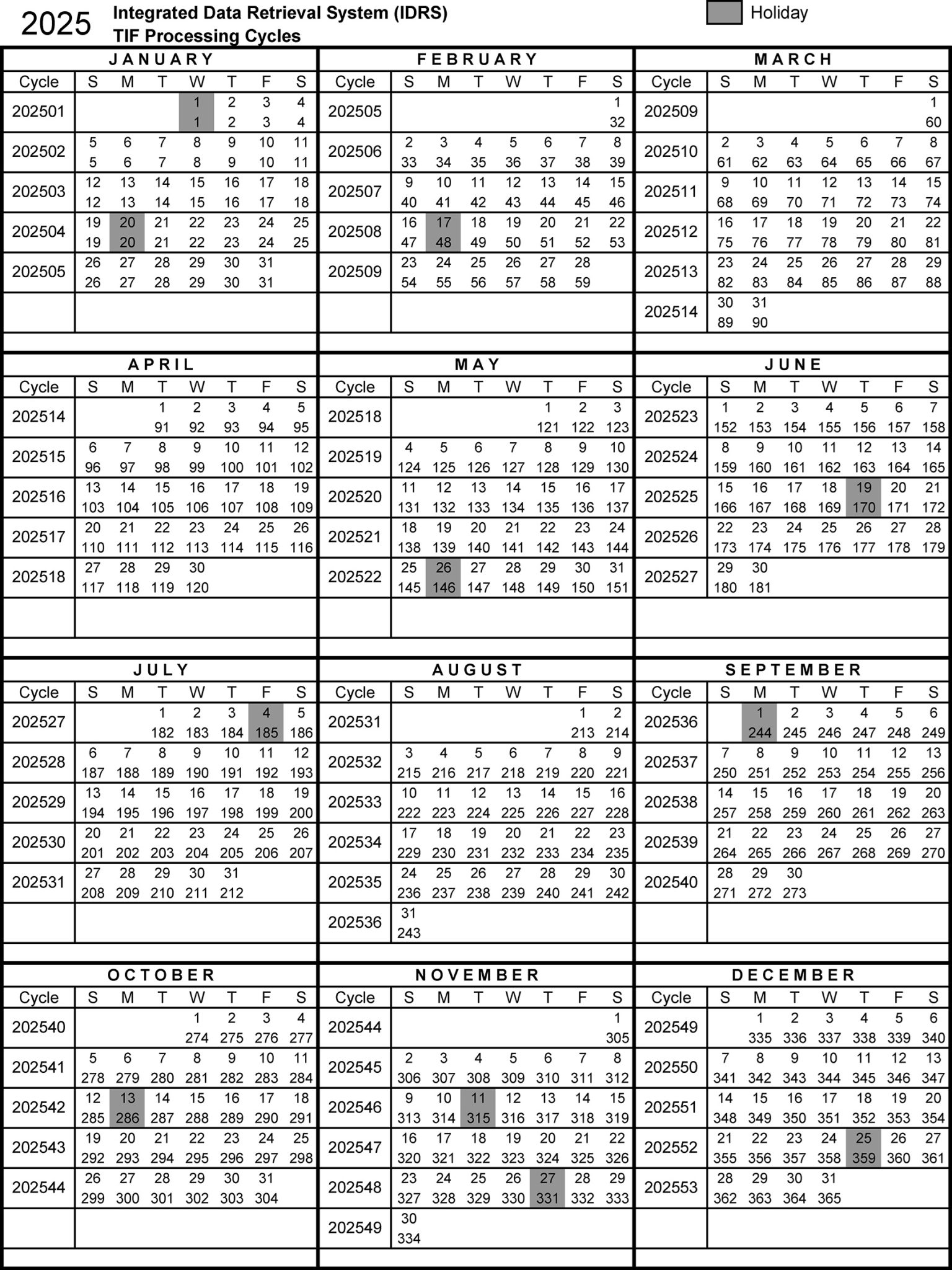

2025 Tax Transcript Cycle Code Charts ⋆ Where's My Refund? Tax News Tax day for the year 2026 is celebrated/ observed on wednesday, april 15. Taxpayers can check the status of their irs refund for 2026 by using the ‘where’s my refund?’ tool on the irs website or by calling the irs refund hotline.

Source: geraldgclewis.pages.dev

Source: geraldgclewis.pages.dev

Calendar Tax Refund 2025 Gerald Clewis Likely the final day to file federal taxes unless the irs announces changes (e.g., due to holidays or emergencies). With significant irs workforce reductions, the 2026 filing season could see challenges and delays.

Source: imranfaye.pages.dev

Source: imranfaye.pages.dev

Irs Tax Refund Dates 2025 Imran Faye This page will be updated for tax year 2026 as the forms,. For the 2026 tax year (covering income earned in 2025), the season is expected to open in late january 2026 and end on.

Source: toddmanderson.pages.dev

Source: toddmanderson.pages.dev

2026 Calendar With Holidays Printable Pdf Todd M. Anderson Here's a summary of the major tax law changes coming in 2026 and some steps individuals and business owners can take to prepare. While not an exhaustive list, here are the key changes that will.

Source: utpaqp.edu.pe

Source: utpaqp.edu.pe

2026 Archives Hipi Info Likely the final day to file federal taxes unless the irs announces changes (e.g., due to holidays or emergencies). Tax day for the year 2026 is celebrated/ observed on wednesday, april 15.

Source: esterjwilliams.pages.dev

Source: esterjwilliams.pages.dev

Tax Refund Schedule 2025 Direct Deposit Form Ester J. Williams Tax day for the year 2026 is celebrated/ observed on wednesday, april 15. Taxpayers can check the status of their irs refund for 2026 by using the ‘where’s my refund?’ tool on the irs website or by calling the irs refund hotline.

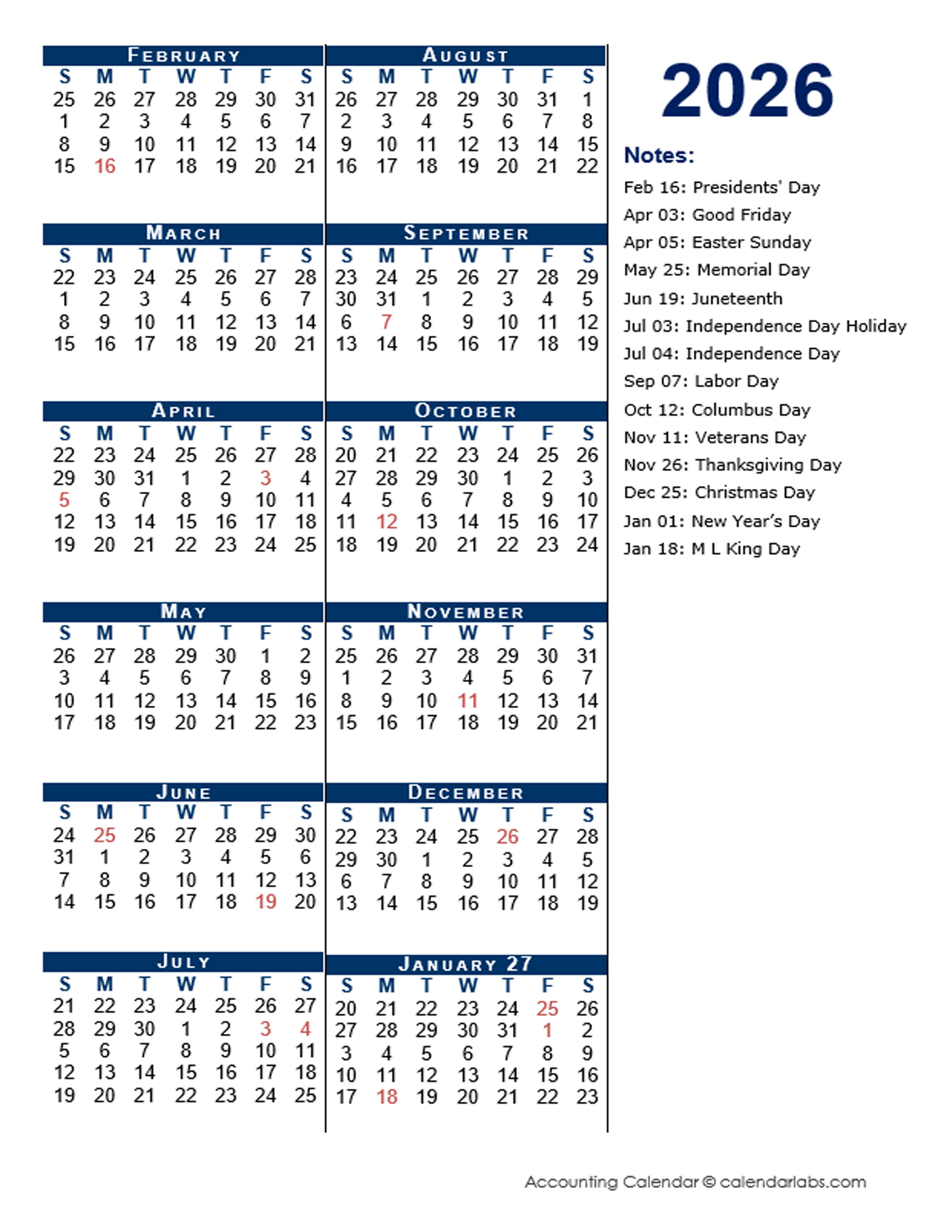

Source: www.calendarlabs.com

Source: www.calendarlabs.com

2026 Fiscal Period Calendar 445 Free Printable Templates For the 2026 tax year (covering income earned in 2025), the season is expected to open in late january 2026 and end on. Here's a summary of the major tax law changes coming in 2026 and some steps individuals and business owners can take to prepare.